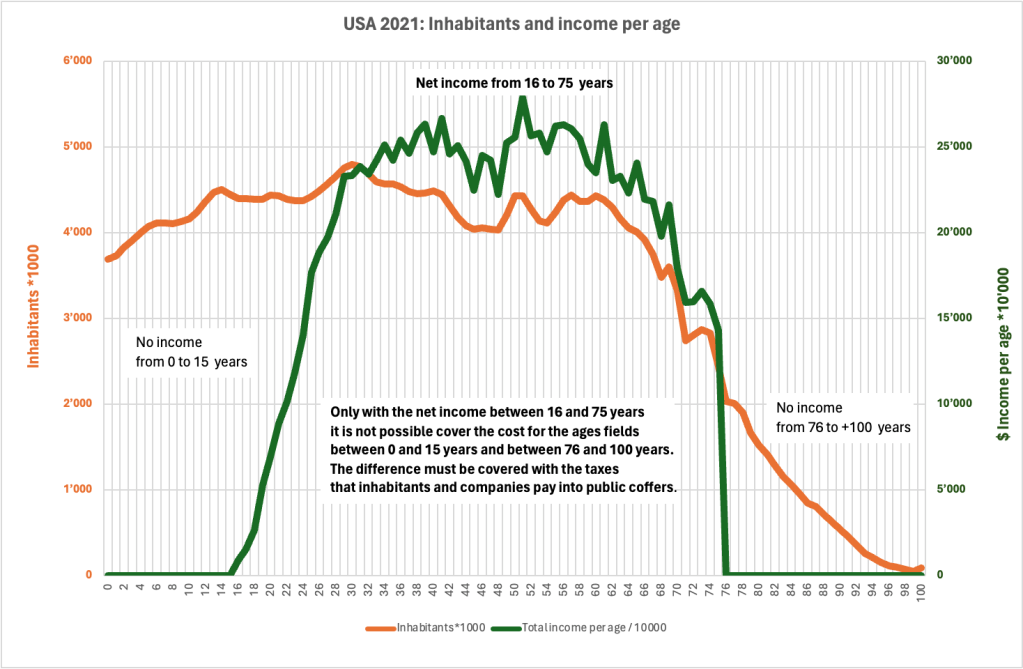

Multiplying the number of inhabitants by age group by their annual income gives the total income by age. The following graph shows the income for all age groups that alone is not sufficient to support the needs for the education of young people and the livelihood of the elderly.

The difference must be covered with the taxes that inhabitants and companies pay into public coffers.

The data used comes from links:

https://population.un.org/wpp/Download/Standard/MostUsed/ https://statistics.cepal.org/portal/cepalstat/dashboard.html?indicator_id=184&area_id=408&lang=en

The graph shown for the United States of America can also be considered valid for the most advanced Western countries as well as for Japan, Australia and New Zealand. Employees are employed and paid in the age group between 16 and 75 years, during which they are subject to levies intended to build up and maintain the funds intended to cover the period of retirement. The population pyramid shows strong anomalies at the base: the age groups between zero and thirty are decreasing and consequently the withdrawal intended for pension is reduced. In addition, life expectancy for older people has increased and is expected to increase further in the short to medium term. These last two phenomena, which are difficult to govern, are not adequately taken into account by government bodies, trade union representatives or even by the workers themselves. In the situation that has arisen, all possible remedies present decisions that penalize everyone. In the hypothesis of positive growth, moderate inflation and without increasing the debt of nations, the resources of all workers, pensioners and to a lesser extent also the youngest should be involved. In addition, taking into account the short-medium term developments and forecasts of the national and global economies, consideration should be given to adjusting the taxation of private and public companies and companies. A further measure, to be considered almost indispensable, is the increase in the retirement age, except for some openings concerning activities that are both physically and mentally very exhausting. The idea of widening the base of the growth pyramid is certainly to be pursued, but even in this case there are many difficulties. For the inhabitants of a nation, this would mean creating financial conditions for a strong and sustained effort to meet the needs of families with two or more children. Welcoming and managing migrants from other countries is a good thing when it is possible to provide them with fairly paid and sustainable work for a reasonable number of years. Changes to our working model would also be very useful with regard to the retirement age to be made flexible and/or partial. Another important innovation could concern workers over 55-60 years of age, who could accept less demanding tasks and roles accompanied by a change in their salary. All the measures considered, plus others, should be taken in the coming years in order to stabilize both the growth pyramid, including the third and fourth ages, in favor of a more sustainable system of contribution levy and a certain and prolonged pension income, thus safeguarding nations from a dangerous recourse to increasing indebtedness.

Leave a comment